We're proud to announce that Portable has reached a milestone of $100,000 USD in loans to communities around the world through the micro-financing platform Kiva.

In 2017 we reviewed the ways we could deliver impact beyond our immediate area of service delivery in design and technology, and looked a range of initiatives open to us.

We know that in many parts of the world, access to secure banking and finance can lift people out of poverty and build long-term resiliency. In 2016, traditional banks catered to only 33% of the total number of borrowers looking for micro-financing globally.

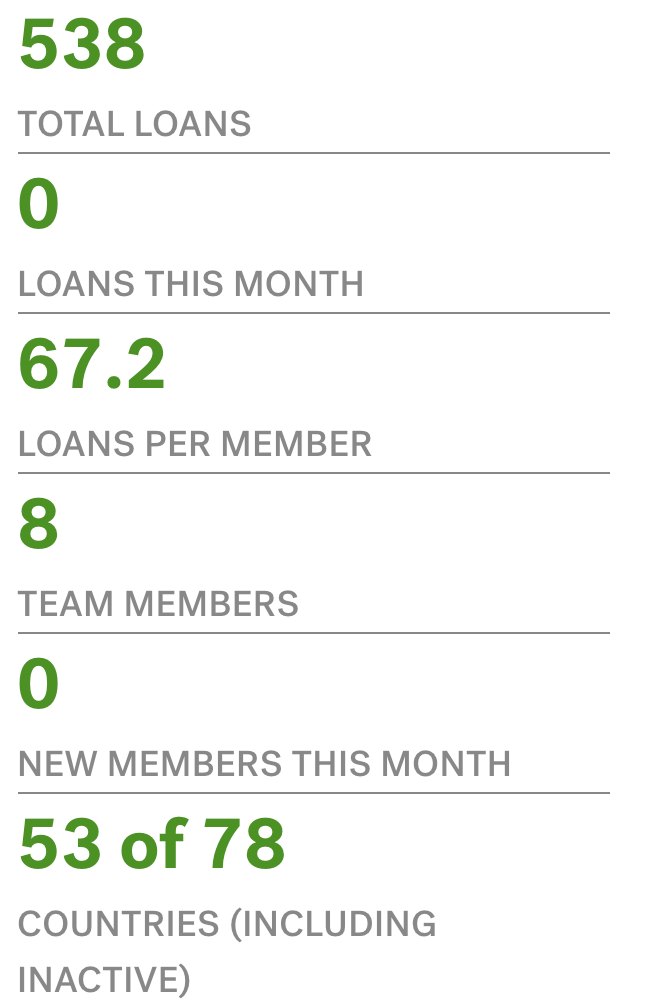

We rationalised that loaning money to communities beyond Australia could deliver significant, ongoing impact, that could be measured and shared. This contribution is something that as a team we are extremely proud of, and we see it as a start: going into 2020 we will look to loan a minimum of $20,000 USD a month.

If you would like to see more details about our Kiva lending, visit our Portable team page.

What micro-lending is and does

If you've heard of micro-lending but aren't sure you have the full scope of why this has become such a big thing, then here are the basics. Micro-lending is the process of lending small amounts money to people who may not be able to get a bank loan.

There are two common reasons why people become lenders of micro-loans, either they are looking to lend to individuals in developed countries who can't get credit from banks, or they are looking to lend for humanitarian purposes to improve financial inclusion and reduce poverty. Portable's lending with Kiva sits firmly with the latter.

Micro-lending began with a single man, Muhammad Yunus, who started offering small loans to women in the village of Jobra, Bangladesh. The popularity of these loans and lending platforms is growing, with 123 million customers at micro-finance institutions worldwide in 2016.

The Stats

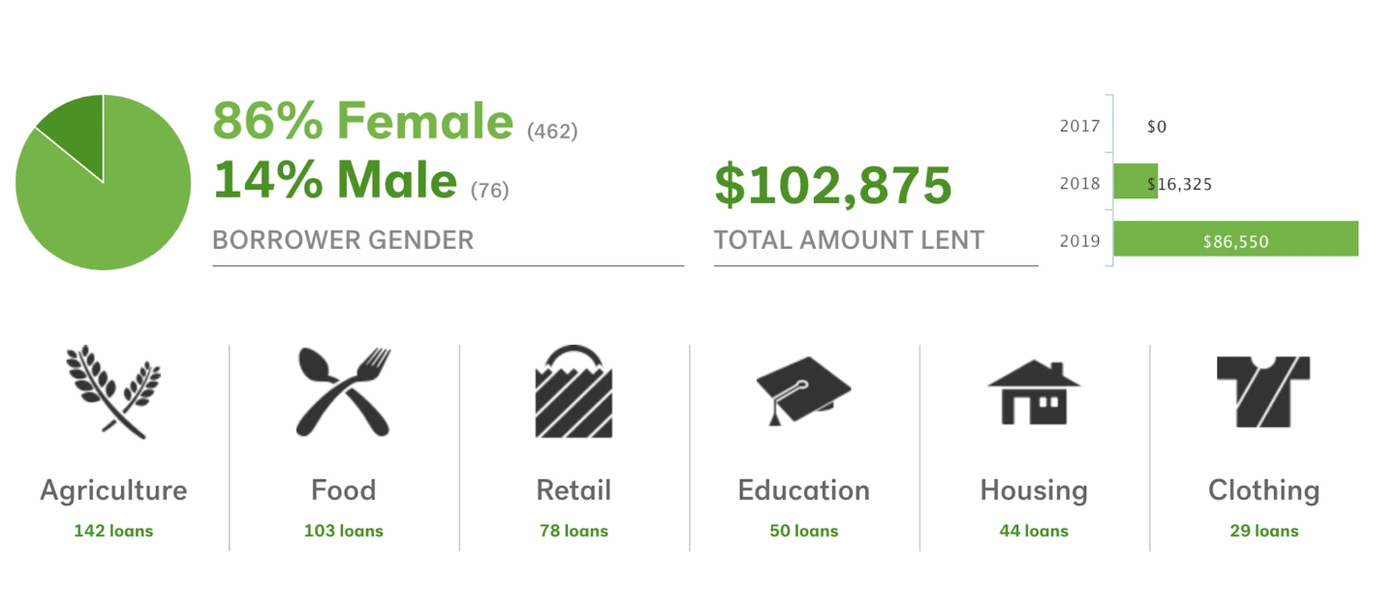

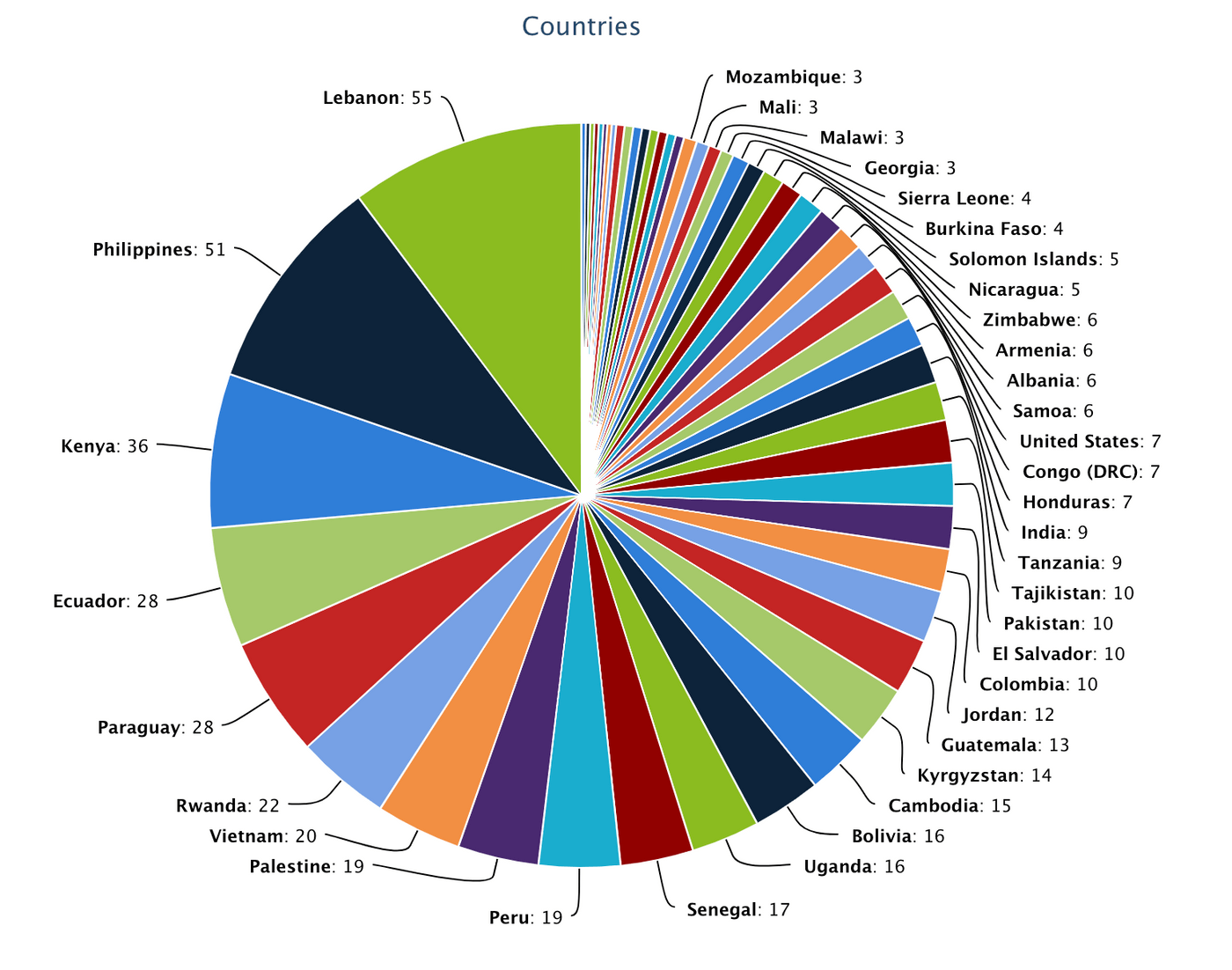

The loans we are supporting through Kiva are being distributed worldwide, but particularly in places like Lebanon, the Philippines, Kenya, Ecuador, Paraguay, Rwanda, and many more. As of October 1, we have made over 500 loans to communities and individuals in 52 countries around the world.

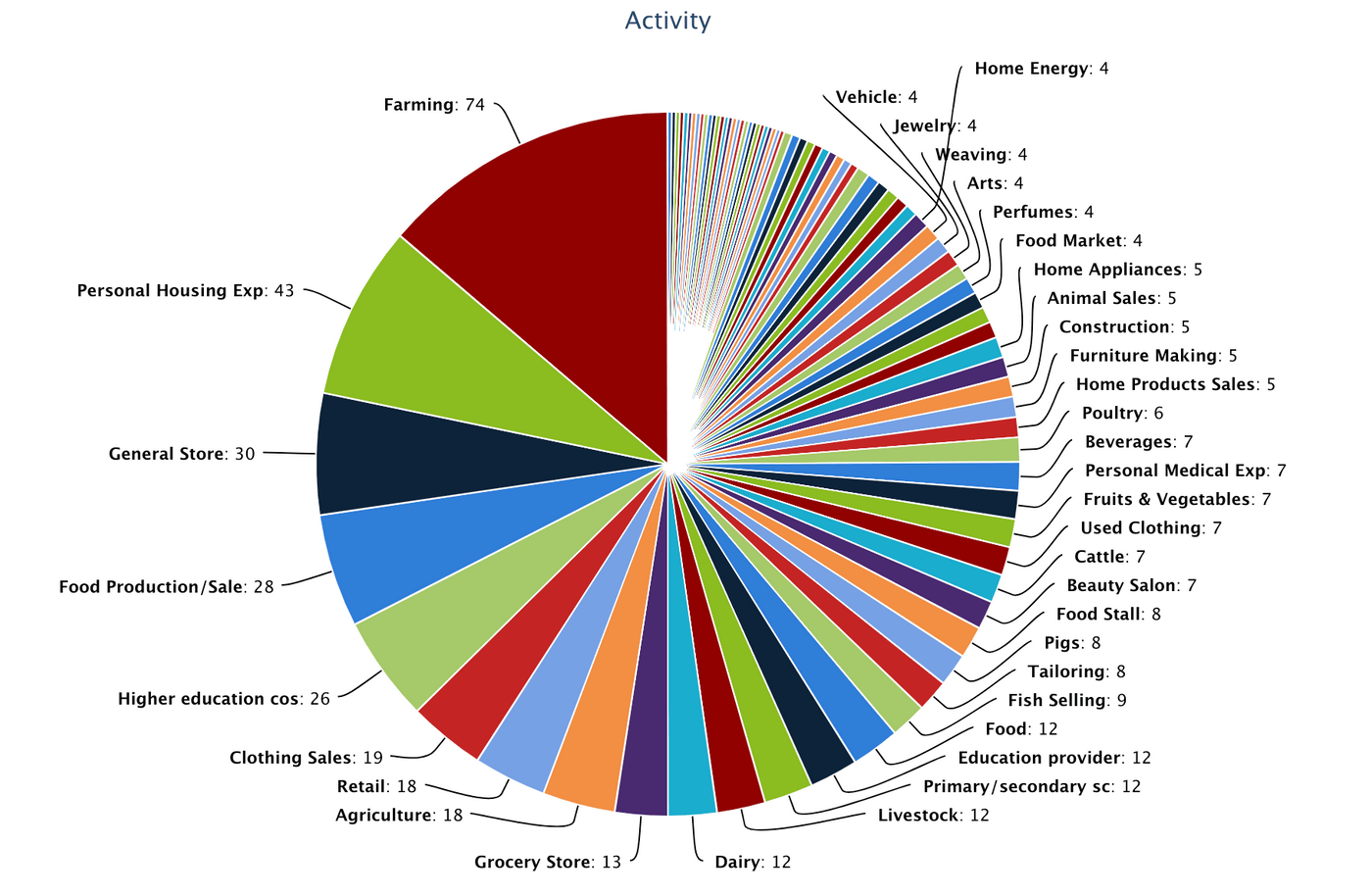

The majority of our loans have been made towards agricultural projects (137 loans), however we support food, retail, education and housing project. And because we know the impact of women in increasing outcomes, 85% of our loans are to women-led projects.

How it connects to the Portable vision?

We made the decision to join Kiva as a part of our commitment as a B-Corp to create better business for a better world. As a B-Corp we are legally required to consider the impact of our decisions on our workers, customers, suppliers, community and the environment. On top of this, our professional goal is to use advances in design and digital technology to dramatically transform the lives of citizens and the wider public.

One way we found that we could unite these goals was through Kiva and lending money to those who need it, which would help change individual lives and create ripple effects in their communities because of these loans. Our lending with Kiva is not in pursuit of profits, and any money repaid by those who receive a loan from us is handed straight back to Kiva so it can keep helping communities.

This is not our first foray into work aiming to help individuals facing difficult circumstances to overcome hardships, and it won't be the last. Recently we completed work with the Australian Red Cross to help people seeking asylum in Australia to identify and develop ways to foster purpose and personal agency and create new pathways and opportunities in communities across the country. We have also previously worked with the Dept. of Justice and Regulation to create an online Family Violence Intervention Order application, and the Queensland Department of Child Safety, Youth and Women to deliver an in-depth report on improving the experience with the justice system for victim-survivors of family violence.